Dear friends,

Welcome to the Samhain / the coming of the dark edition of the Mutual Fund Observer!

October is an interesting month. Traditionally perilous for the financial markets. It begins with the sullen remnants of summer and ends with festivals of the harvest (even for those of us in cities) and of the coming season when nature slips into dormancy. Halloween, whose sales now begin in August and whose iconic ghouls now glower at Santa Claus in Costco, is rooted in Samhain, a pagan Celtic festival welcoming the coming of “the dark half” of the year.

So, celebrate, while we can, “Autumn…the year’s last, loveliest smile.”

(The phrase is often attributed to the poet William Cullen Bryant (1794-1898) though I can’t for the life of me find it in the original.)

Update: We now know, “The ‘loveliest smile’ phrase appears in a poem by WC’s brother John H Bryant.” Many thanks to David Moran.

In this month’s issue …

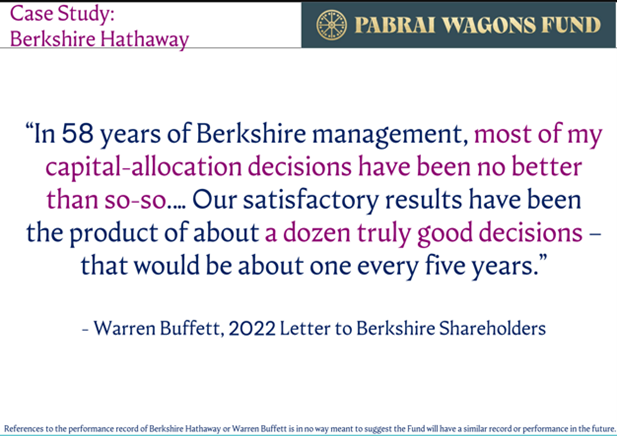

My colleague Devesh had the rare opportunity to speak with Mohnish Pabrai, a renowned Indian investor who embraces many of Warren Buffett’s principles and had a long acquaintance with Charlie Munger. Mr. Pabrai brought his concentrated style of investing in the US market a year ago with the launch of his Wagons Fund. Wagons, as in “it’s time to circle the wagons, boys!” wagons. Devesh talks with him in special depth about the six buckets into which almost all of his assets flow.

We share a Launch Alert for a fascinating new fund from CrossingBridge, CrossingBridge Nordic High Income Bond Fund, which went live on October 1. It’s a high-income strategy from a singularly successful adviser in a distinctive market niche that no other fund touches. At base, the Nordic market is large, transparent, quickly growing … and a venue for smaller European and American issuers to raise capital when other avenues are foreclosed.

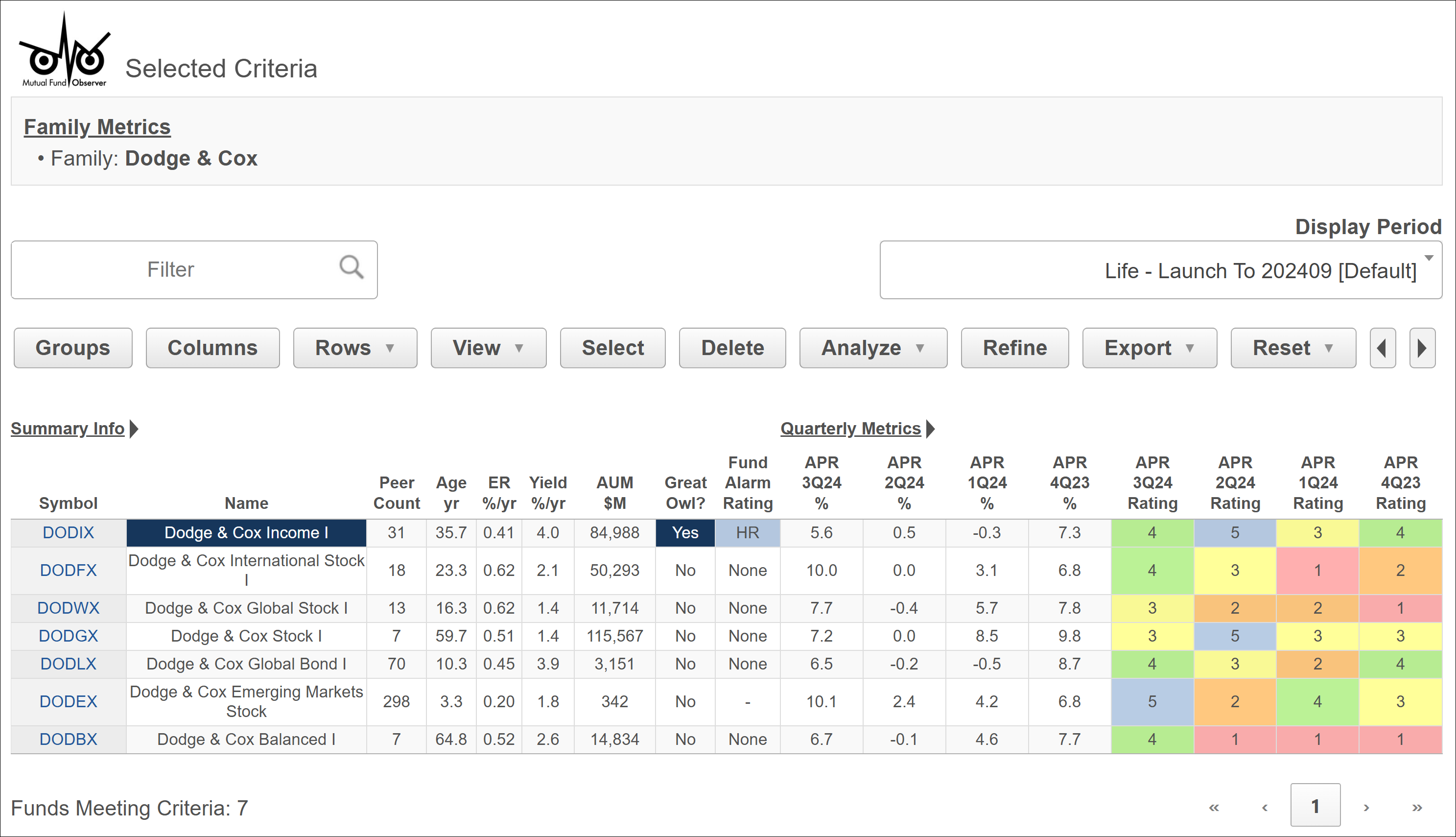

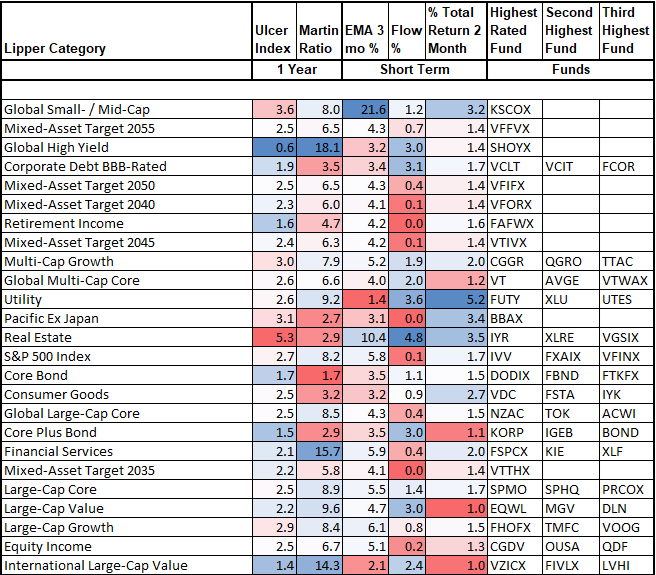

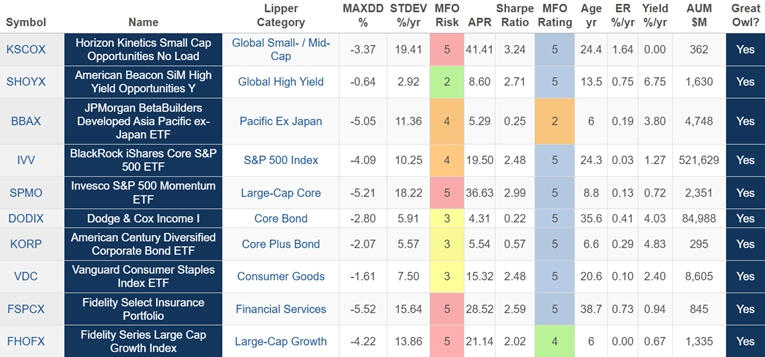

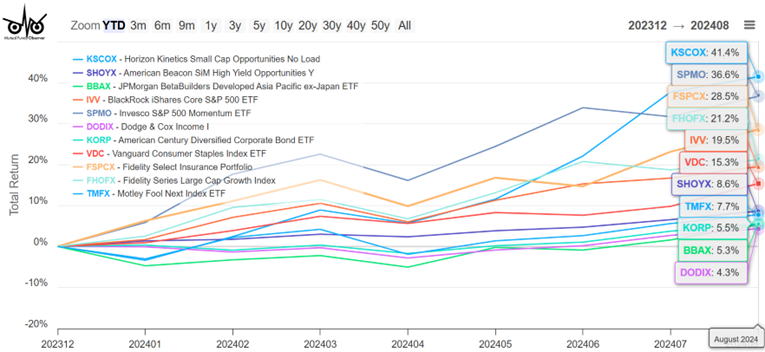

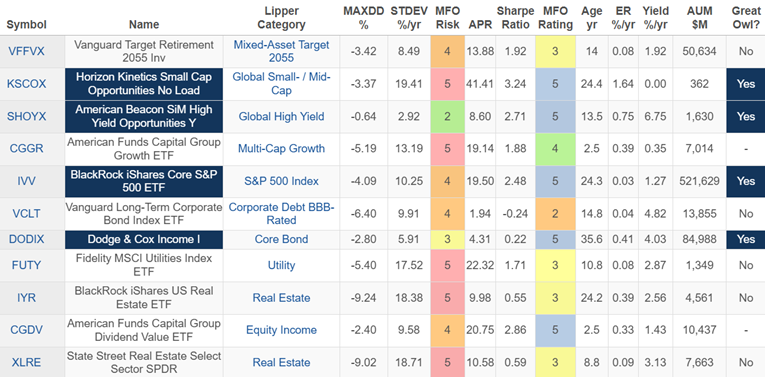

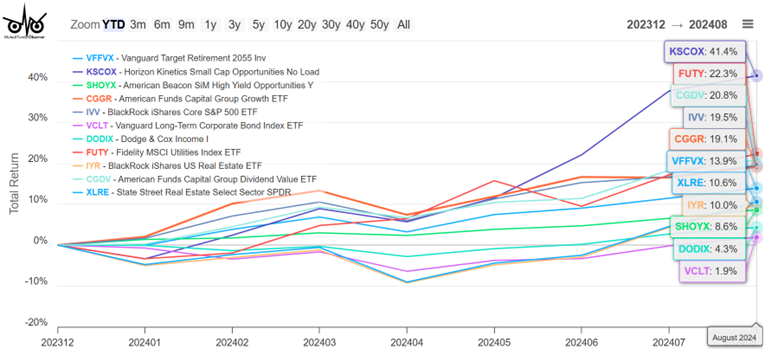

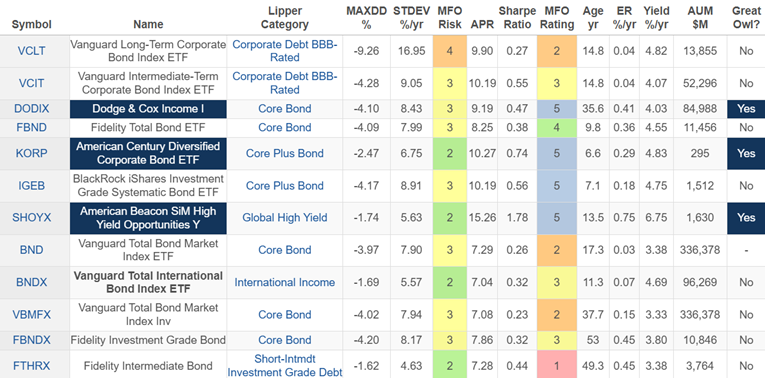

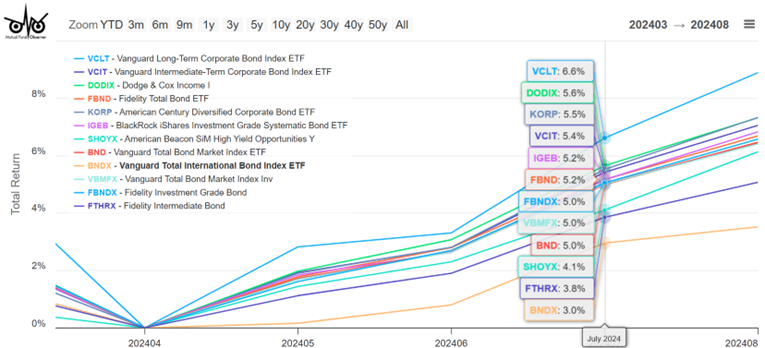

Our colleague Lynn Bolin shares two essays this month. In the first, Lynn notes that “we are at an inflection point with short-term interest rates falling and the yield curve” normalizing. He hopes to offer some insight into the next six to twelve months in the market by looking at momentum measures in the 800 funds and ETFs he tracks. In the second, he examined options for pursuing “Underconsumption Core,” a sort of “cottagecore for your budget” financial movement that seems to be taking hold on TikTok. With something like 65% to 75% of Americans living paycheck to paycheck, he reflects on some useful ideas on how to cut spending and save more.

The Shadow, vigilant as ever, chronicles SEC actions against two famous firms, a half dozen interesting options in the pipeline, bits of good news for investors … and about a dozen death notices.

Finally, I came very close to finishing a fund profile for this issue, a process derailed by:

For you city folks, that’s the back of our gardens. And that’s a possum. Most particularly, that’s a possum firmly wedged under the fence, halfway between our yard and Colin’s. In lieu of finishing edits on the fund profile, I worked on excavating Peter (or Petra) Possum. Failing at that, I introduced myself to my new neighbor Colin, who borrowed a shovel and worked on undercutting P’s hindquarters. (That was about as popular as you might imagine.)

At last sighting, P was finally free of the fence but unable, or disinclined, to extricate itself from its hole. And so, as Chip publishes this issue, I’m going to go offer it a paw-paw.

No, that’s not a cute way of saying “high-fiving a possum.” It’s a non-commercial (tasty) fruit native to the Midwest. Just the thing to take the sting out of a day-long confinement. I hope. Anyway, we’ll share the profile in November! Thanks for your patience.

Smart people say “hi!”

I had the opportunity to chat this week with three sets of smart people. The always-engaging David Sherman chatted about the peculiar delights of the Nordic high-yield bond market. The results of that chat are chronicled in the Launch Alert for CrossingBridge Nordic High Income Bond.

I had occasion to be in the Twin Cities to help my son, Will, move to a new apartment. I took the opportunity to drop by The Leuthold Group where I got to chat with long-time confidant Paula Mikl, CIO Doug Ramsay, and portfolio manager Chun Wang. We discussed market valuations (stupid high, again), the investment management business (things are pretty stable for them, their ETF isn’t cannibalizing assets, and they’re partnered with a Texas firm to extend their distribution network), and Leuthold Core (both the fund and the ETF). The ETF charges 60 bps less than the fund and has a slightly higher yield with minor divergences in performance. Both funds have the same tactical allocation, the difference is that the ETF implements it by buying about 24 ETFs. That makes the strategy cheap but “less granular on the industry level” than the fund. Since inception, both the returns (45.79% vs 45.61%) and volatility are remarkably close. Some of the firm insiders own the fund, others are buying the ETF. Being Minnesota, we had coffee … and I got a really cool cell phone-enabled coffee mug out of the visit!

I had occasion to be in the Twin Cities to help my son, Will, move to a new apartment. I took the opportunity to drop by The Leuthold Group where I got to chat with long-time confidant Paula Mikl, CIO Doug Ramsay, and portfolio manager Chun Wang. We discussed market valuations (stupid high, again), the investment management business (things are pretty stable for them, their ETF isn’t cannibalizing assets, and they’re partnered with a Texas firm to extend their distribution network), and Leuthold Core (both the fund and the ETF). The ETF charges 60 bps less than the fund and has a slightly higher yield with minor divergences in performance. Both funds have the same tactical allocation, the difference is that the ETF implements it by buying about 24 ETFs. That makes the strategy cheap but “less granular on the industry level” than the fund. Since inception, both the returns (45.79% vs 45.61%) and volatility are remarkably close. Some of the firm insiders own the fund, others are buying the ETF. Being Minnesota, we had coffee … and I got a really cool cell phone-enabled coffee mug out of the visit!

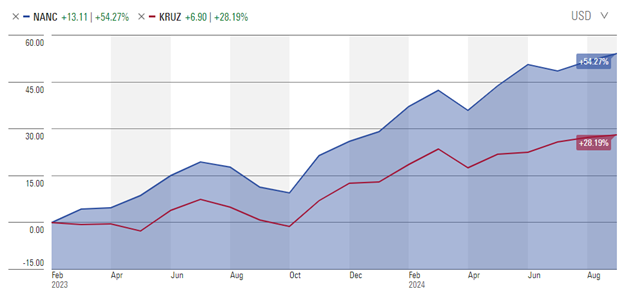

Finally, I had a chance to talk a bit with Minyoung Sohn and John Fenley. Min managed the $8 billion Janus Growth and Income Fund from 2004-07, left Janus to found ArrowMark Partners where he managed Meridian Enhanced Equity and grew the company to a $24 billion firm, and then left ArrowMark to found Blue Room Investing.

Finally, I had a chance to talk a bit with Minyoung Sohn and John Fenley. Min managed the $8 billion Janus Growth and Income Fund from 2004-07, left Janus to found ArrowMark Partners where he managed Meridian Enhanced Equity and grew the company to a $24 billion firm, and then left ArrowMark to found Blue Room Investing.

John’s career is marked by excellence in international small-cap investing, a strategy that he pursued at Hansberger and Denver Investments where he managed Westcore International Small Cap which eventually became part of Segal, Bryant & Hamill. While there, John became their Director of Fundamental International Strategies. He joined Blue Room in 2023. Between them, Min and John have a shelf full of performance awards and accolades. The firm is successful and committed to doing good, as much as doing well. Part of that process includes discussions, still in their infancy, about returning to the ’40 Act world, either with their own fund(s) or as sub-advisers on an international small-cap or long/short equity strategy. Given their record and good sense, either development would be a major win for investors. We’ll keep you apprised.

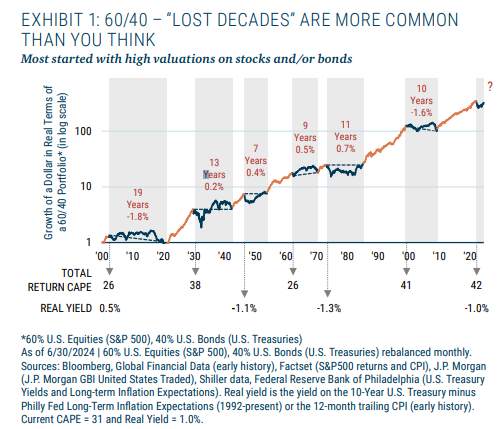

Lost decades

GMO offered an interesting and sobering reminder to the “the market is my friend” crowd. If you were born in 1900 and lived until your 85th year, you would have spent more than half of your entire life experiencing “lost decades” in the financial markets.

More than half your life. Yikes.

This, in a nutshell, is the argument for diversification – those numbers would look far different with a slice of Japanese equities, for instance – and for focusing on reasonable goals (my retirement portfolio needs to earn 6% a year for me to have a reasonable prospect of security when I stop full-time work), reasonable time frames (three years isn’t it), and a reasonable set of life choices (never buy a new car, live in the space you need rather than the space you want, find joy in people rather than possessions, cook).

What a difference a box makes

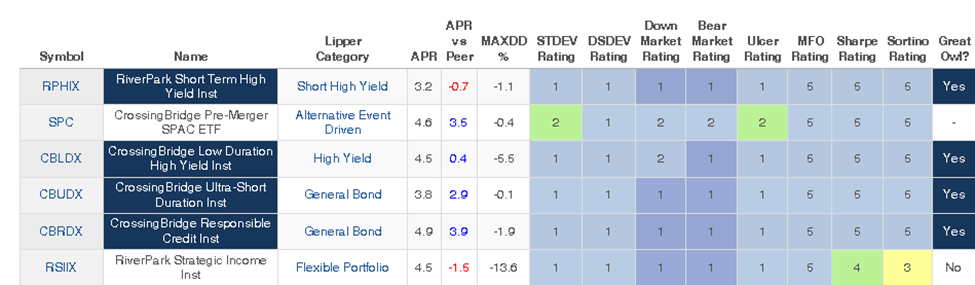

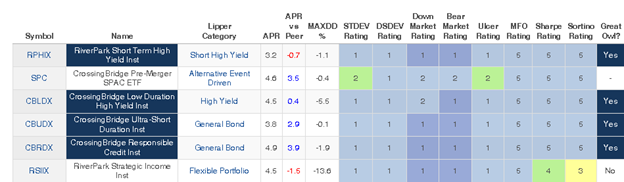

In our Launch Alert for CrossingBridge Nordic Bond, we include a table of the risk-adjusted performance since the inception of all the CrossingBridge Funds. (Short version: top tier across the board.) Each is compared to its Lipper peer average.

CrossingBridge founder David Sherman notes that Morningstar and Lipper assign the funds to dramatically different peer groups and has some reservations about Lipper’s assignments.

CrossingBridge Pre-Merger SPAC ETF (Financial Stock, but formerly Small Cap Growth, at Morningstar, Alternative Event-Driven at Lipper)

I think the CrossingBridge Pre Merger SPAC ETF should be categorized in the ultra-short duration bond category since it meets the duration definition backed by US Treasuries in SPAC escrows and the Fund always redeems or sells but never rolls into deals.

RiverPark Strategic Income (High Yield Bond at Morningstar, Flexible Portfolio at Lipper)

RiverPark Strategic Income is a flexible conservative high-yield fund. It has the flexibility to reduce high-yield exposure and move into investment grade when spreads seem overvalued or other conditions exist from a bottom-up, value investor standpoint. Flexible category funds are typically top-down funds making calls on interest rates, term structure, and economic views.

CrossingBridge Low Duration High Yield (Multisector bond at Morningstar, High Yield at Lipper)

CrossingBridge Low Duration High Yield (CBLDX) has historically been a max of 65% high yield and a duration mandate of typically 2 or less … so different than the traditional high yield category. These differences are the reason behind changing the name and refiling a prospectus with SEC for review (still awaiting comments) to High Income.

All of which is worth knowing because the easy judgments – “it’s a five-star fund! Buy!” – are driven by those sometimes-questionable peer group assignments. The reason that MFO focuses less on ratings and more on a manager’s strategy and impulses is to keep you from acting based on “peer-adjusted performance” when, well, they aren’t actually peers.

The four questions you need to ask yourself

- Do I know what the manager is doing?

- Does my portfolio need what he’s doing?

- Have they managed to do it consistently, amid changing markets?

- Am I comfortable with the short-term risks, including volatility and peer underperformance, that I’m likely to experience?

Anything less than four “yeses” means “not for me!”

The World Goes Round

We note with sadness the closing of Rondure Global Advisors, a woman-owned investment adviser founded in 2016 and headquartered in Salt Lake City, Utah. Laura Geritz, CFA is Rondure’s founder, co-CIO, and CEO. She began her career at American Century as a bilingual investor relations representative, a position that continues to shape her thinking about her investors, their needs, and her obligations to them. She moved to the investing side in 1999 at American Century and eventually joined Wasatch Funds in 2006. She has been phenomenally successful as a professional investor. Lewis Braham, writing in Barron’s about her work at Wasatch International Opportunities, concluded that she “crushed” her peers (“Should You Follow a Star Money Manager?” Barron’s, 9/10/2016). Her signal charge, Wasatch Frontier Emerging Small Countries, returned 15 times what her competitors did. But as she traveled to those challenged and striving countries, she came to a poignant and powerful conclusion:

Somewhere along the path of making money, I got too busy to do as much good as I aspired to.

Founding Rondure was a way to return to that desire. The firm has three core principles: make money for our clients, Do Good, and be great partners.

In the last week of September 2024, Ms. Geritz penned the “Final Shareholder Letter,” which is both somber and modestly mysterious:

It is with heavy hearts and thoughtful consideration that we inform you that the Rondure New World Fund will be liquidated on October 18, 2024, and with this closure, we will also be closing Rondure Global Advisors.

The economic landscape of our emerging markets-focused strategies has been challenging for some time. Our entire team has been dedicated to facing those challenges with the constant objective to achieve long-term positive returns for our clients and investors. Unfortunately, recent unforeseen developments within our business have forced us to reevaluate our ability to continue. It is a painful outcome and certainly not a decision we anticipated ever having to make, particularly when we think emerging markets remain such an interesting and compelling long-term investment. We did not make this decision lightly, but ultimately, consideration of the economic and operational realities of continuing the firm have led us to realize closing is the best outcome for our clients.

In a subsequent conversation, Laura pointed to the sudden and unexpected confluence of factors, unmanageably rising costs and health challenges, as conspiring to make it impossible for Rondure to continue. Her two priorities now are caring for her staff and her investors. She is working to make it possible for her shareholders to gain access to the soft-closed Grandeur Peak Emerging Markets Opportunities Fund if they want to maintain exposure to the style and assets. That’s a rare and thoughtful gesture but hardly surprising given her character.

We wish all involved godspeed.

Thanks, as ever . . .

To The Few, The Proud, The Ongoing Contributors: Wilson, S&F Investment Advisors, Gregory, William, the other William, Stephen, Brian, David, and Doug! Legitimately, thanks, guys.

An exceptional number of folks, and a number of exceptional folks, made contributions this month which will dramatically expand the opportunities we can pursue. So thanks to the Suranjan Fund, Dr. Mary of Atlanta Financial Psychology (thanks for the kind words! We try hard to convince regular folks that they can make sense of the system if they just have faith and keep it simple.), Mitchell of Washington, Leah from Cambridge, Frederic of Wisconsin, Rad of California, Andrew from Orefield, Sunny of California, Martin from Columbus, and Mark of Michigan.

And my dear departed friend Nick Burnett, through the generous intermediation of his wife, Debbi. Of all the people I’ve known, Nick is the one who most earned the accolade, “larger than life.” Cheers, buddy. Thanks, Debs!

You Matter

Act like it.

The children are watching.

And waiting, to inherit what we leave them.

The devastation in places that were supposed to be idyllic and iconic – places like Asheville, North Carolina, where friends have been celebrating retirement – has been much on my mind. “We have biblical devastation through the county,” said Ryan Cole, the assistant director of Buncombe County Emergency Services. And yet Asheville was often enough described as “a climate haven,” insulated from the worst effects of global warming.

Death threats against a company owner in Springfield, Ohio – “family-built, American-owned, making metal work in America since 1965 … some say American manufacturing isn’t what it used to be. Apparently, they haven’t spent time in Springfield” – who had the temerity to say publicly that his Haitian employees were good workers, has been on my mind. “They come to work every day. They don’t cause drama. They’re on time. I wish I had 30 more.” That led to a voicemail on the company answering machine: “The owner of McGregor Metal can take a bullet to the skull and that would be 100 percent justified.” His children and 80-year-old mother have also been threatened.

Death threats against a company owner in Springfield, Ohio – “family-built, American-owned, making metal work in America since 1965 … some say American manufacturing isn’t what it used to be. Apparently, they haven’t spent time in Springfield” – who had the temerity to say publicly that his Haitian employees were good workers, has been on my mind. “They come to work every day. They don’t cause drama. They’re on time. I wish I had 30 more.” That led to a voicemail on the company answering machine: “The owner of McGregor Metal can take a bullet to the skull and that would be 100 percent justified.” His children and 80-year-old mother have also been threatened.

Jimmy Carter, who improbably celebrated his 100th birthday, on 30 September 2024, has been on my mind. Mr. Carter was diagnosed with brain cancer in 2015. He entered hospice in 2023 and lost the love of his life that same year. They had been married for 77 years. His family usually frames his future in terms of weeks. And still, he persists. He was not a great president, his skills and temperament did not align with the challenges of the job, but he was arguably the best person to hold that office in the 20th century. I still remember Mr. Carter’s bulky sweaters in winter, and his decision to install solar panels on the roof of the White House. Mr. Reagan had them ripped out. The younger President Bush quietly installed solar on a maintenance building on the White House grounds and President Obama restored them to the White House roof.

Nazi propaganda has been on my mind, too. The National Socialist propaganda had two fairly distinct phases, the “make Germany great again” phase from about 1932 – 1937 and the “eradicate the enemy within” phase from about 1938 – 1945. Some fascinating new work by scholars at Cambridge on a recently uncovered British intelligence analysis from April 1942, apparently unread for 80 years, focuses on Hitler’s growing obsession with “the enemy within,” which the British speculate was driven by a growing realization that his cause was lost. As his desperation grew, his underlings accelerated the Final Solution, a phase so virulent that concentration camp commanders were continuing genocide even when they knew the war had been lost and that Allied forces would seize their camps within days.

The use of such rhetoric – “the threat from outside forces is far less sinister, dangerous and grave than the threat from within,” descriptions of domestic opponents as “vermin” and immigrants as “poisoning the blood of the country,” all at a single Veteran’s Day speech – by an American aspiring to lead the nation, has been on my mind. A lot.

That fact that folks cheered, likewise.

The hardest act of faith, sometimes, is recalling that even in perilous times, you matter. We are, each of us, teachers. We are teaching our neighbors what we think of them. We are teaching children who they should become. And we are teaching ourselves, in small daily actions taken and not taken, who we will become.

The hardest act of faith, sometimes, is recalling that even in perilous times, you matter. We are, each of us, teachers. We are teaching our neighbors what we think of them. We are teaching children who they should become. And we are teaching ourselves, in small daily actions taken and not taken, who we will become.

Really, do you want to be the people you see on TV? If not, then don’t act like them. Be a good steward of the world gifted to us. Respect those who most loudly disagree with you, knowing that a good heart still lies beneath many fevered words. Be gentle with your flaws. Be stalwart in your willingness to do good: to vote, to encourage others, to stop the doom-scrolling, to speak in terms of policies rather than merely personalities, to push those who lead to take the devastation wrought by a warming planet seriously, to support those whose lives have been shredded. Channel Jimmy.

Know that touching one life is better than touching none. Planting one tree is better than leaving the field barren.

Know that the children are watching.

As ever,